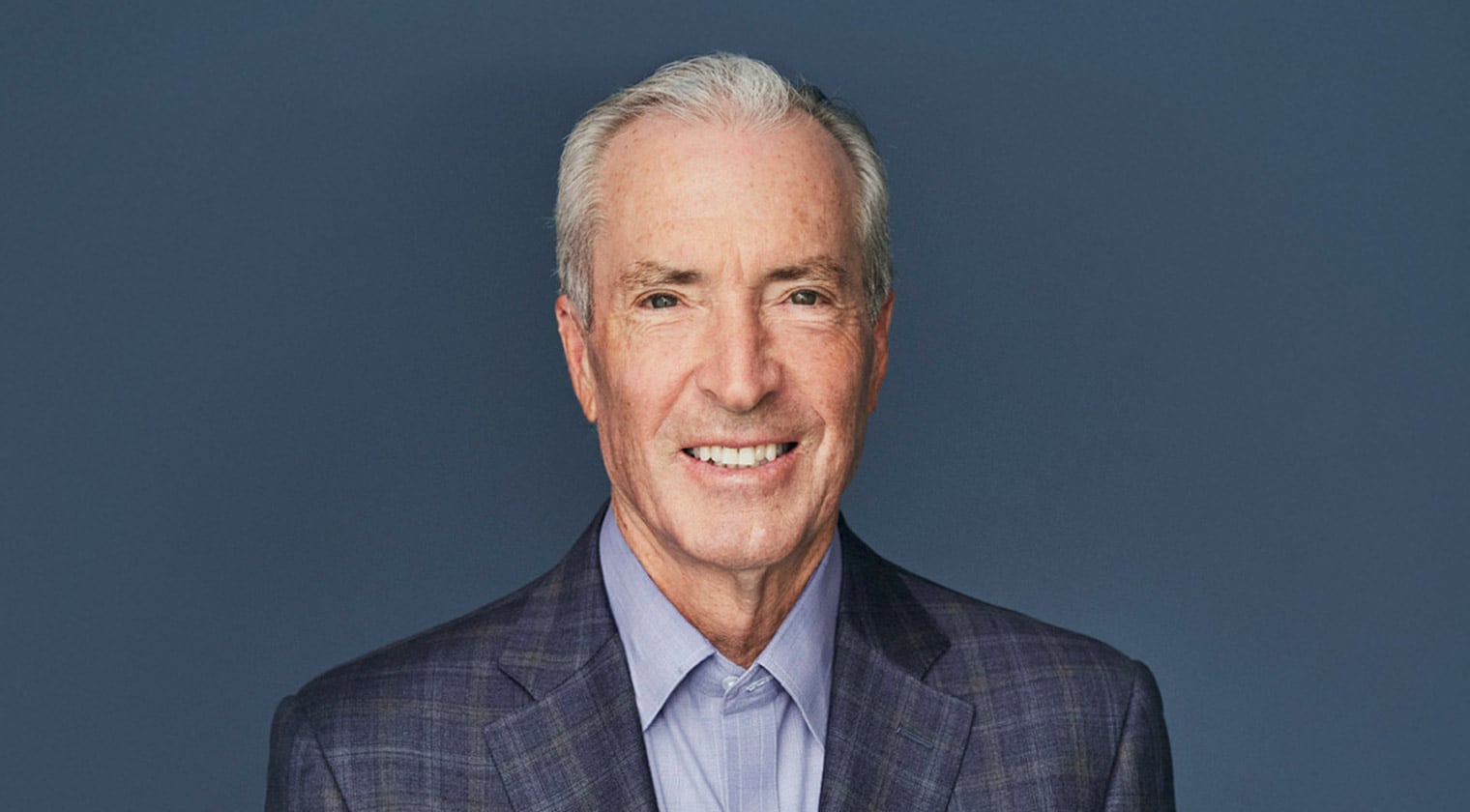

Rich DeMartini is a seasoned financial services executive and investor with a distinguished career in asset and wealth management. He most recently retired in 2021 as Partner and Head of Financial Services Strategy at Crestview Partners, where he now serves as Vice Chairman.

Prior to Crestview, Rich served as President of Bank of America’s Wealth and Asset Management Group from 2001 to 2004, overseeing the bank’s global wealth and investment operations. Before that, he spent 26 years at Morgan Stanley, where he held several senior leadership roles including Chairman and CEO of the International Private Client Group, Co-President of Asset Management, Co-President of Dean Witter & Company, Inc., and Chairman of Discover Card.

Rich has held directorships at numerous public and private companies. He was a founding member of Partners Capital and previously served as Chairman of the Board of the NASDAQ Stock Market. Rich currently serves as Lead Independent Director of Victory Capital Management (NASDAQ: VCTR).

Beyond finance, Rich is actively involved in the arts and sports. He is a Trustee and a former Chairman and President of the Whitney Museum of American Art. An avid sports investor, he is a shareholder in Major League Soccer team Nashville SC and the founder of Elm Rock BV, which owns and manages show jumping horses that compete internationally.

Rich earned a Bachelor of Arts from San Diego State University, where he attended on a tennis scholarship.